STAFF WRITERS

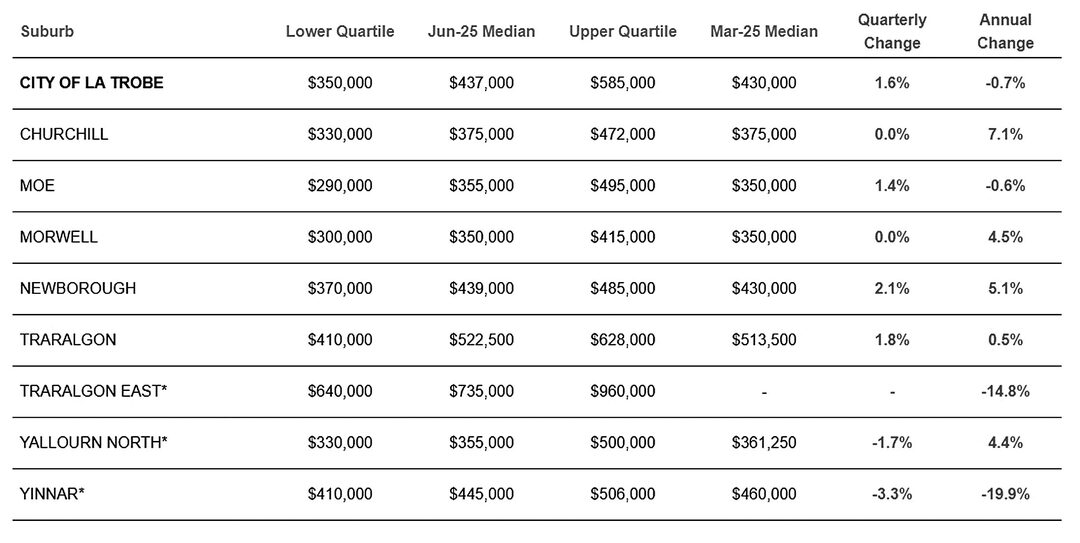

THE latest quarterly house price data from the Real Estate Institute of Victoria (REIV) for Latrobe shows a positive rebound in Q2.

Traralgon and Newborough led the rise at 1.8 per cent and 2.1 per cent respectively.

Newborough in particular has also defied statewide 12-month price falls and instead risen 5.1 per cent.

Churchill (7.1 per cent) showed the highest annual growth and a median house price of $375,000.

House and unit prices across Victoria have risen for a second consecutive quarter as interest rate cuts, climbing wages and easing living costs drive renewed market confidence.

Quarterly median data from REIV has shown that in the three-month period to June 30 (Q2 2025), house prices climbed 0.4 per cent and units climbed 1.3 per cent compared to the previous quarter.

In regional Victoria, houses rose 2.6 per cent and units rose 3.1 per cent.

Quarterly growth was seen by Melbourne’s outer suburbs, including Frankston (nine per cent up at $815,000) and Frankston South (12.8 per cent up at $1,300,000) at the base of the Mornington Peninsula.

In regional Victoria, houses in Greater Mildura saw 3.9 per cent quarterly and 11.3 per cent annual price growth, with the regional town of Merbein (north west of Milbura) showing a 13.4 per cent quarterly increase and 29 per cent annual growth.

Greater Bendigo is another region that has enjoyed quarterly and annual growth, with 20 of Bendigo’s 27 suburbs climbing quarter-on-quarter and a median house price of $580,500.

Despite two consecutive growth quarters, annual price movement across the state has remained flat or slightly fallen below June 2024 values, with metro houses down 0.6 per cent and regional houses down 0.8 per cent.

REIV Interim Chief Executive, Jacob Caine said this quarter’s medians indicate improving economic conditions and a case for both buyer and seller optimism.

“Buyers and sellers across the state appear to be cautiously confident as cash rate cuts, annual wages growth and signs of easing living costs drive another quarter of widespread but modest growth. In addition, the market is seeing encouraging signs that the supply of new residential housing in Victoria appears to be outpacing other states,” he said.

“It’s pleasing to see that throughout the first half of 2025, transaction activity has held strong and plenty of buying options exist across Victoria for all budgets and lifestyles.”