Bryce Eishold

A scathing report into a government decision to award Morwell company Steelvision a $650,000 grant has found the business provided “inaccurate” and “non-compliant” financial documents to obtain taxpayer money.

The report also found government bureaucrats failed to follow mandatory grant administration guidelines, causing “high-risk issues” of non-compliance in several areas of the grant’s agreement.

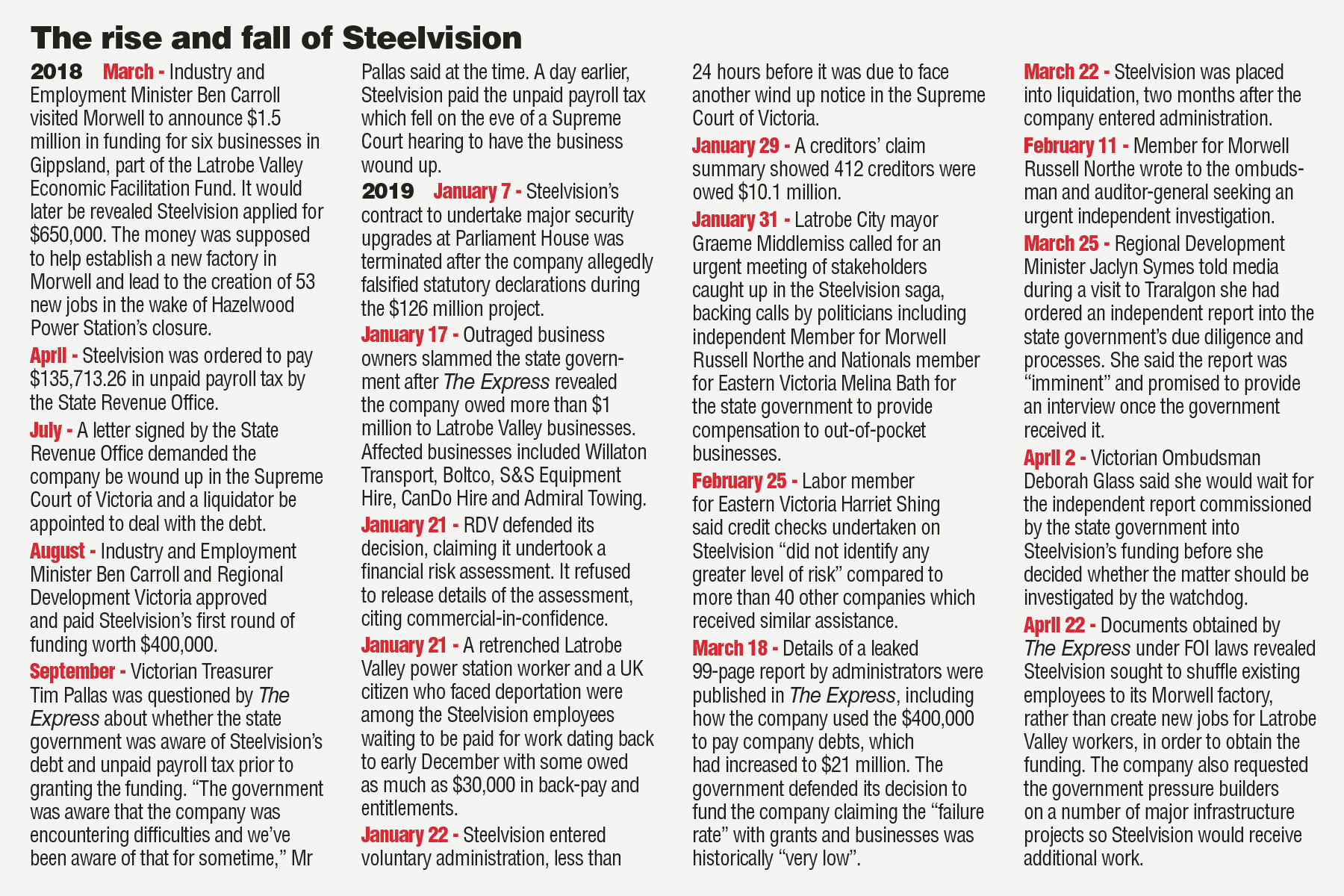

The damning 26-page report by KMPG, which has been released by the state government today, also found the government ticked-off on the grant despite not undertaking the appropriate checks and balances and that the company was “technically insolvent” when it received the money.

The company only received the first milestone payment of $400,000 just months before it entered administration.

The Grants Program Framework Steelvision Pty Ltd Case Study makes 25 recommendations including strengthening risk assessment processes and improvements to how bureaucrats assess and track the progress of companies receiving taxpayer money.

Related:

“Our examination noted four high risk rated non-compliance findings … relating to application, assessment, contract finalisation and monitoring, and one moderate risk rated finding relating to grant approval,” the report states.

The embattled company received the grant to establish a precast concrete and high security building fixture factory at Morwell with the promise to create 53 full-time jobs.

However, six months after receiving the grant, the company entered administration owing businesses across Australia more than $21 million, including more than $1 million to Latrobe Valley businesses.

Last month, the government referred “suspected fraudulent conduct” by Steelvision to Victoria Police.

“The KPMG review has highlighted significant shortcomings with how the department assessed and managed this grant,” Regional Development Minister Jaclyn Symes, who has been under pressure to release the report in recent weeks, said.

“While it is rare for a grant recipient to fail, the approach that was taken last year is entirely unacceptable, and I have instructed the secretary of my department and the new chief executive of RDV to significantly strengthen how grant applications are assessed and monitored.”

The report states “financial risk mitigations were not taken” by the government and a ranking of medium high given by bureaucrats “cannot be justified with the [liquidity] ratio, finance and debt structure and declining profitability”.

“If the project had been assigned a high rating it may not have proceeded,” the report states.

The investigation also found the company was “technically insolvent” when it received the funding in August 2018.

Details about projected cashflow forecasts and operational profit were also not provided to the government to assess and highlight the liquidity risk of the company, the report states.

The government ordered the independent review into the decision after The Express revealed in March the company used the $400,000 taxpayer grant to pay creditors rather than for its intended purpose to develop its Morwell factory.

Within weeks of receiving the funding, the company was brought before the Supreme Court of Victoria to be wound up over unpaid payroll tax concerns.

The report also states financial accounts provided to the government for 2015 and 2016 were “inaccurate” and contained errors, did not reconcile between years and were in a non-compliant financial format.

Ms Symes said in the wake of the report, Regional Development Victoria’s grants program would undergo a more rigorous financial risk assessment and introduce better training for departmental staff in how to manage and approve grants.

A second internal report released by the government today states RDV attempted to support the company in the wake of its “financial issues” by offering it a separate $25,000 grant to provide “corporate advisory services”, however, the company entered administration and the grant was not taken up.

The KPMG report also found Steelvision provided draft management accounts for 2017, however, they were not signed by the company’s accountant or auditors which failed to “confirm financial performance”.

More in Monday’s Express.